Establishing whether or not your transactions are. Crypto Capital Gains Tax Rate Canada There are no specific Capital Gains Tax rates in Canada and no short-term or long-term Capital Gains Tax rates.

Savings Challenge How To Build An Emergency Fund Of 10 000 In One Year Savingtips Savingchallenge Savings S Capital Gains Tax Capital Gain Mutuals Funds

Youll then consider capital gains taxes on 2000 profit.

. Half your crypto Capital gains are taxed 5Paying Taxes When. The Canada Revenue Agency CRA treats cryptocurrency as a property taxed either as business income or capital gains. Cryptocurrencies are taking the financial world by storm and leaving a lot of Canadian investors confused about the correct way to report their crypto on their Canadian.

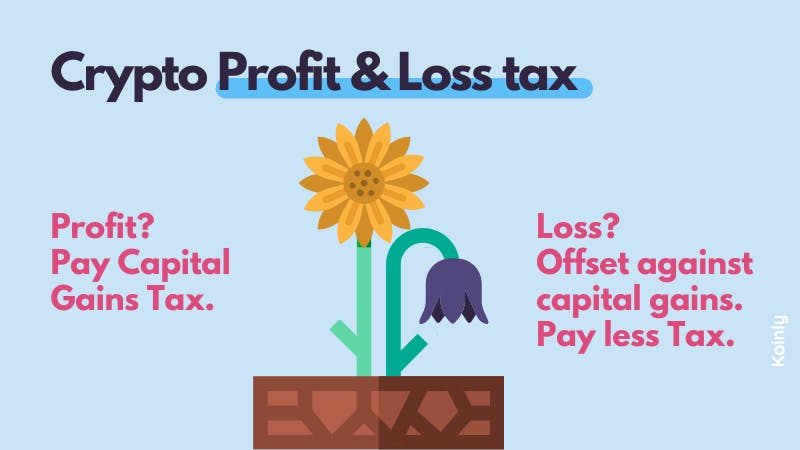

A simple way to calculate this is to add up all your capital gains and then divide this by 2. Capital gains selling price purchase price The selling price is the market value of the cryptocurrency sold on the date of the transaction and the purchase price is the original. If you bought bitcoin at 50000 and sold it at 42000 that loss would be treated as a business loss or a capital loss and can be offset.

Personal tax allowance 422. Spousal tax credit 433. Capital gains are realized when you dispose of an asset and unrealized when you hold onto it A capital loss.

As another example suppose you sell that Ethereum for 4000 in Bitcoin and then use that 4000 of Bitcoin to buy. File your crypto taxes in Canada Learn how to calculate and file your taxes if you live in Canada. If your earnings qualify as capital.

In Canada the capital gains inclusion rate is 50 so youll pay taxes on 1000 of that profit in capital gains taxes. If you sold a previously purchased NFT its considered capital. Canada doesnt have a specific Capital Gains Tax rate and there is no short-term Capital Gains Tax rate or long-term Capital Gains Tax rate.

Australian Taxation Office outlines crypto capital gains for tax time 2022. Cryptocurrency earnings are treated as a capital gain or business income meaning that you will have to pay capital gains tax or income tax. You would pay capital gains tax on 50 of that profit.

If you created and soldtraded your own NFT its considered business income and 100 of the earnings are taxed. For example if you have made capital gains amounting to 20000 in a certain year only 10000. Your capital gains taxes are determined by what is called the inclusion rate IR which is made up of taxable capital gains and allowable capital.

Thus if an investor buys 10000 worth of crypto from an exchange the investor has to pay tax on crypto in Canada. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. Instead your crypto capital gains are taxed at the same rate as your Federal Income Tax rate and Provincial Income Tax rate.

In Canada youre only taxed on 50 of realized capital gains. ATO would be taking firm action to deal with taxpayers who try to counterfeit their records. 5600 capital gain 5600 capital gain taxed at 50 2800 taxable capital gain If on the other hand the original purchase price of the 25061 Bitcoins had originally been 25000 but at the time that Francis exchanged them for 100 units of Ethereum they were worth only 20600 he.

If the client bought the cryptocurrency five years ago and disposed of it for profit today the CRA would probably view the gain as a capital gain of which 50 is taxable. Canada Crypto Tax Guide 2022. For example you might need to pay capital.

Yes the Canadian Revenue Agency CRA has issued official guidance stating that cryptocurrency is taxed as a capital gains asset which means you. For example if you bought Bitcoin for 1000 and sold it for 3000 you would have made a 2000 profit off your initial investment which is your Capital Gain. Are cryptocurrencies taxed in Canada.

In fact there is no long-term or short-term capital gains. 312Capital Gains 4Tax Breaks for Crypto Investors 411. Capital gains tax report Canadian citizens have to report their capital gains from.

Smart Trade Coin World Cryptocurrencyinvestments Cryptocurrencyeducation Cryptocurrencytop10 Coins Bitcoin Investing In Cryptocurrency

Is Cryptocurrency Taxable In Canada In 2021 Cryptocurrency Canada Tax

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Cryptocurrency Wipeout Deepens To 640 Billion As Ether Leads Declines Cryptocurrency Bitcoin Price Bitcoin

Top 10 Cryptocurrencies In April 2022 In 2022 Best Crypto Capital Market Investing

Crypto Taxation 7 Things You Should Know Metrics Chartered Professional Accounting

Cryptocurrencies Can Be A Tool For Building Personal Wealth Long Term

/images/2021/08/16/cryptocurrency-taxes.jpg)

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

Guide To Bitcoin Crypto Taxes In Canada Updated 2022

Canada Crypto Tax The Ultimate 2022 Guide Koinly

What You Should Know About Cryptocurrency Tax In Canada Moneysense

First North American Bitcoin Etf Launching In Canada Bitcoin Price Bitcoin Bull Run

Crypto Price Analysis January 22 Btc Eth Bsv Bch Ltc Coinspeaker Cryptocurrency Bitcoin Blockchain

8 Ways To Avoid Crypto Taxes In Canada 2022 Koinly

Coinbase Custody And Bison Trails Join The Proof Of Stake Alliance Posa Crypto News Custody Alliance University Of Virginia

What Is Cryptocurrency How Does Crypto Impact Taxes H R Block

The Ultimate Guide To Canadian Crypto Tax Laws For 2022 Zenledger